Healthcare organizations face mounting financial pressures from all directions. Staffing shortages, complex reimbursement models, evolving regulations, and increasing technology costs create a perfect storm for revenue cycle operations. This growing complexity has led many providers to explore End-to-End (E2E) Revenue Cycle managed services as a strategic solution.

While outsourcing revenue cycle management (RCM) functions can deliver significant benefits, selecting the right partner requires careful evaluation. This article serves as the initial framework of critical factors for the evaluation of RCM service providers to ensure optimal financial performance and operational efficiency. Establishing an end-to-end RCM services partnership is extremely complex and typically should not be undertaken without the support and guidance from parties experienced in shaping E2E RCM relationships.

GENERAL CONSIDERATIONS

1- Expertise in Healthcare Revenue Cycle Management

The healthcare revenue cycle demands specialized knowledge that goes far beyond general billing and collections. When evaluating potential RCM partners, industry-specific expertise should be your first consideration.

2-Breadth of Service Offering

Relatively few RCM service providers can be classified as true End-to-End. Healthcare revenue cycle encompasses more than coding, billing, and collections, and your future RCM partner should have the capability to effectively manage and optimize all RCM functions. The scope of a true end-to-end managed services partnership often includes all revenue cycle functions, including scheduling, registration, coding, through insurance, and patient collections. Inquiring into the maturity of niche revenue cycle functions, like scheduling, uninsured eligibility, complex claims, revenue integrity, and clinical documentation improvement, will help determine if these high-value RCM functions will continue to deliver their intended outcomes.

3-Approach for “Re-badged” Employees

Healthcare providers appropriately place an elevated value on the staff that may be impacted by a transition to an end-to-end Managed Service Partner. The savings realized by the Healthcare Provider can be a result of the reduction of RCM roles currently filled by staff of your organization. While a reduction in labor is never ideal, it is important that you understand how work will potentially transition to a different workforce or become automated. Including a time-bound employment guarantee or specifying a predefined role transition schedule can be included in a partnership master services agreement (MSA).

4-Regulatory Compliance Experience

Healthcare revenue cycle operations must navigate complex regulatory requirements, including HIPAA, HITECH, and constantly evolving CMS regulations. Your RCM partner should function as a compliance ally, not a potential liability.

Evaluate potential vendors’ understanding of healthcare-specific compliance requirements, their history of maintaining compliance, and their processes for adapting to regulatory changes. Request documentation of their compliance programs and any relevant certifications.

5-Technology Integration and Capabilities

Technology serves as the backbone of modern revenue cycle operations. The right end-to-end revenue cycle managed services partner should offer advanced technological capabilities that integrate seamlessly with your existing systems.

6-EHR/EMR Compatibility

Seamless integration with your electronic health record or practice management system is essential. The best RCM partners can work with all major platforms and have established integration protocols to ensure smooth data exchange without disrupting clinical workflows. Many service providers are willing to operate directly within the provider’s EHR.

7-AI and Automation Capabilities

Advanced RCM partners leverage artificial intelligence and robotic process automation to improve efficiency and accuracy. According to the Healthcare Financial Management Association, organizations using AI-driven RCM tools report a 30% reduction in claim denials and 25% faster payment processing.

8-Analytics and Reporting

Comprehensive analytics capabilities provide visibility into performance metrics and identify improvement opportunities. Look for vendors offering real-time dashboards, customizable reports, and predictive analytics that help you make data-driven decisions.

“The difference between a good RCM partner and a great one often comes down to their technology stack and how well it integrates with your existing systems. The right technology can transform your revenue cycle from a cost center to a strategic asset.”

– Healthcare Financial Management Association

9-Cybersecurity and Data Protection

With healthcare organizations being prime targets for cyberattacks, your RCM partner’s security protocols are critically important. Evaluate potential vendors’ security certifications (such as HITRUST or SOC 2), encryption standards, access controls, and breach notification procedures. Request documentation of regular security audits and penetration testing.

10-Compliance and Risk Management

Effective compliance and risk management strategies are essential components of end-to-end revenue cycle managed services. Your RCM partner should help mitigate risks while ensuring regulatory adherence.

11-Audit Readiness

The best RCM partners maintain comprehensive documentation and follow processes that keep you prepared for payer audits, RAC audits, and other regulatory reviews. Ask potential vendors about their audit support services, documentation practices, and how they’ve helped other clients successfully navigate audits.

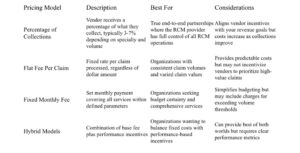

PRICING

The decision on pricing models depends on multiple factors that are dependent on the needs of the organization. The percentage of Collections tends to align with those partnerships that are most strategic.

1-Pricing Model

2-Hidden Costs to Consider

Beyond the base pricing model, be alert to potential hidden costs that could impact your total investment:

- Implementation and training fees

- System integration costs

- Charges for additional services (clinical documentation improvement, physician education, coding audits, etc.)

- Contract termination or transition fees

- Costs for reporting and analytics beyond standard offerings

- Fees for handling legacy accounts receivable

3-Incentives and Performance Guarantees

Regardless of the pricing model that best fits the organization, it is strongly recommended that healthcare organizations consider a value-based pricing option to incentivize the RCM partner to not just maintain performance levels, but to achieve best practice operating performance.

Leading RCM partners stand behind their services with meaningful performance guarantees. These may include:

- Gain-share arrangements for exceeding collection goals

- Financial penalties for missing key performance targets

- Refunds for service failures

- Satisfaction guarantees during initial contract periods

TRANSITION

The transition to end-to-end revenue cycle managed services represents a significant operational change. A well-planned implementation process is essential for minimizing disruption and accelerating time-to-value.

1-Timeline and Milestones

Understand the expected timeline for full implementation and key milestones along the way. Ask potential partners for detailed implementation plans, including realistic timeframes for each phase and clear definitions of what constitutes “go-live” for different service components.

2-Resource Requirements

Clarify what resources your organization will need to commit during the transition. This includes staff time for training, IT resources for integration, and leadership involvement for decision-making.

Request a detailed responsibility matrix that clearly delineates which tasks fall to your team versus the vendor’s team during implementation.

EFFECTIVENESS

1-Scalability and Customization

Healthcare organizations vary widely in size, specialty focus, and specific revenue cycle challenges. The ideal end-to-end Revenue Cycle managed services partner should offer solutions that adapt to your unique needs and can scale with your growth.

2-Adaptability to Operational Scale

Whether you’re a small specialty practice or a large hospital system, your RCM partner should offer appropriately scaled solutions. According to a recent KLAS Research report, 62% of healthcare organizations cite scalability as a top factor when selecting an RCM vendor.

Evaluate how potential partners have served organizations of your size and complexity. Ask for case studies or references from similar clients and inquire about their ability to adjust services as your organization grows or changes. Pay close attention to the partner’s ability to absorb the volume of work within the initial phases of the contract. This risk can be mitigated if your organization transitions the existing workforce over to the RCM partner.

3-Specialty-Specific Expertise

Different medical specialties face unique revenue cycle challenges. Cardiology practices deal with complex procedure coding, while behavioral health providers navigate distinct documentation requirements. Your RCM partner should demonstrate specific expertise in your specialty areas.

Request information about the vendor’s experience with your specific specialties, including their familiarity with specialty-specific coding requirements, common denial reasons, and payer policies that impact your practice.

4-Customization Capabilities

One-size-fits-all approaches rarely deliver optimal results in healthcare revenue cycle management. The best partners offer customizable solutions that address your specific pain points while aligning with your organizational workflows and goals.

Workflow customization: Ability to adapt processes to match your clinical and administrative workflows

- Reporting flexibility: Customizable analytics and reporting to track the metrics most important to your organization

- Service level selection: Options to outsource most functions while keeping specific workflows in-house

- Technology adaptation: Willingness to integrate with your preferred technology platforms

5-Service Level Agreements (SLAs)

Comprehensive SLAs provide clarity and accountability for both parties. Key performance metrics to consider in your SLAs:

Operational Efficiency

- Claim submission timeframes

- Coding turnaround time

- Coding quality

- Authorization processing time

- Denial response time

- Call Center response time

- Payment posting accuracy

Service Quality

- Support response times

- Issue resolution timeframes

- Reporting the delivery schedule

- System uptime guarantees

- Patient satisfaction metrics

MAKING THE RIGHT CHOICE FOR YOUR ORGANIZATION

Selecting the right end-to-end Revenue Cycle managed services partner is a strategic decision that can significantly impact your organization’s financial health and operational efficiency. By carefully evaluating potential partners across the key considerations outlined in this guide, you can identify the partner best positioned to address your specific challenges and help you achieve your financial goals.

Remember that the most successful RCM partnerships are built on alignment of goals, clear communication, and mutual accountability. Take the time to thoroughly vet potential partners, check references, and ensure cultural compatibility with your organization.

The right end-to-end revenue cycle managed services partner will do more than just process claims—they will serve as a strategic ally in optimizing your financial performance, reducing administrative burden, and ultimately supporting your mission of providing exceptional patient care.

Interested in learning how Capsys can support your transition to an outsourced end-to-end revenue cycle solution? Contact us at info@capsysadvisors.com