If you walked the Exhibit Hall of the HFMA Annual Conference in 2025, there is one inexplicable truth: the Revenue Cycle Artificial Intelligence Revolution has begun. History tells us that the pace and timing of revolutions are typically hard to predict, but the outcome becomes increasingly clear once the movement reaches a critical mass. 2025 may be the year when such clarity presents itself.

Here is what we believe:

- The adoption of Artificial Intelligence (AI) in RCM is on the rise, driven by the need for improved efficiency and reduced costs.

- Initial RCM use-cases have proven their value, paving the way for the eventual AI transformation

- AI Technology and Consulting firms focused exclusively within Revenue Cycle are forming, partnering, and acquiring in an effort to achieve the “first mover” distinction.

- Healthcare Providers are desperately seeking clarity on how they should be adopting RCM AI capabilities.

The Start-up Surge:

The profiling of 100 Revenue Cycle AI Technology Companies paints an intriguing portrait of the degree of change forthcoming. 43% of these AI companies were formed within the past 5 years. The majority of these start-ups narrowly focus on a handful of RCM use-cases, often developing solutions prior to securing a scalable customer. The limited breadth of service offerings is indicative of the required investment in AI capabilities. 58% of RCM AI companies have fewer than 100 employees.

California and Texas (particularly Austin) have become the hubs of RCM AI innovation, with 40% of companies residing in these states. This in and of itself is notable as we have historically considered Nashville as the epicenter of RCM innovation. Surprisingly, Nashville is at the bottom of the list for RCM AI companies. While the majority of companies indicate a U.S. Headquarters, the influence of companies formed in India is unmistakable. 42% of AI RCM vendors use India-based engineering teams for the development of their solutions.

Capital Structure and Investment Patterns:

Market consolidation is expected as larger companies acquire smaller AI vendors. This movement towards consolidation has started; however, the new entrants continue to outpace the exits via M&A and insolvency. 42% of RCM AI companies are Venture Capital (VC) backed as a stand-alone entity, while 15% have been acquired by a traditional RCM Managed Service or Tech providers. 22% remain privately, or founder-owned; however, the capital requirements for technology development may limit these companies from achieving their growth and scalability objectives. The Private Equity (PE) and Public markets have yet to overtake this segment, given its relative immaturity and decentralization.

Point Solutions vs. Platforms:

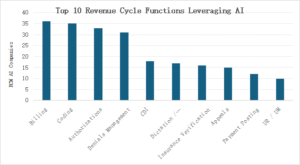

As previously mentioned, many of the new RCM AI companies have hitched their wagon to one compelling RCM use case. On average, RCM AI companies specialize in 3.1 Revenue Cycle functional areas. Fewer than 10% of RCM AI companies deliver AI capabilities in more than six RCM functional areas.

Commonly offered, and potentially most mature revenue cycle AI capabilities are within billing and claims processing, with 36% of AI companies addressing this RCM function. AI will play an even greater role in scrutinizing past claims data to identify trends, forecast the likelihood of denials, and suggest preemptive corrections. This includes real-time claims adjudication, checking claims against myriad rules before submission.

Coding and Authorization workflows are the next most common, with 35% and 33% respectively. AI systems, particularly those using Natural Language Processing (NLP) and machine learning, will continue to improve in automatically translating medical procedures into accurate billing codes from clinical documentation. This reduces human error, speeds up claim processing, and improves accuracy. Generative AI will also streamline complex prior authorization processes.

Source – Capsys LLC, 2025

RCM functions that are relatively immature or under-represented tend to include those functions that are either historically complex or have traditionally necessitated human-to-human interactions. These include customer service call centers, revenue integrity, and credentialing. Outbound patient contact has barely scratched the AI surface.

Conclusion:

The future of Artificial Intelligence within Revenue Cycle Management in healthcare is rapidly evolving and poised for significant transformation. AI and automation are no longer futuristic concepts; they are becoming essential tools for healthcare organizations to navigate increasing financial pressures, staffing challenges, and the demand for improved patient experience. Which RCM AI platforms will become “the standard” will depend on the pace of development and the maturation of the AI vendor network.

Interested in learning how Artificial Intelligence can transform your Revenue Cycle operations? Contact Capsys at info@capsysadvisors.com